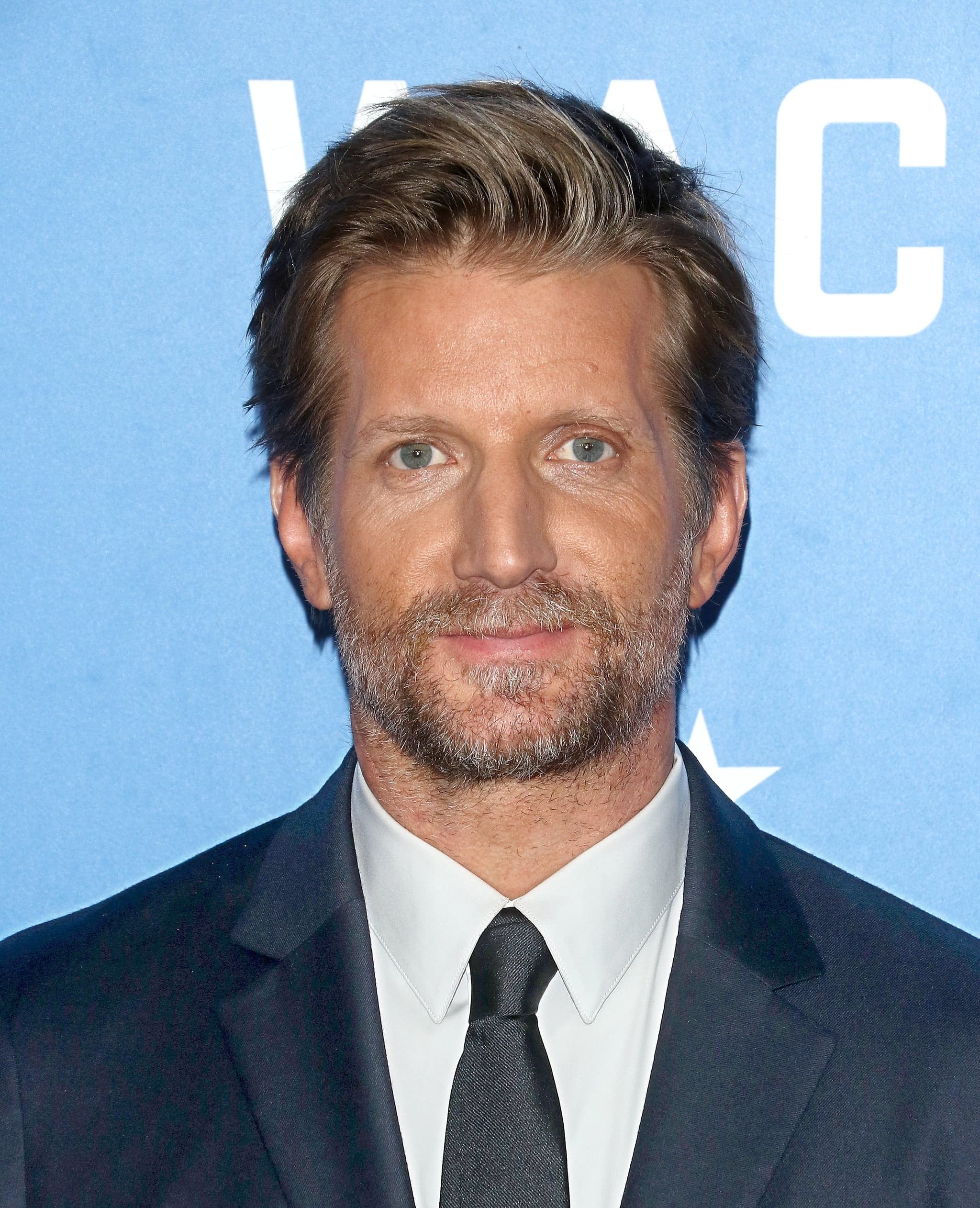

Paul Sparks Net Worth is the total value of the financial assets and liabilities owned by actor Paul Sparks. As of 2023, Paul Sparks Net Worth is estimated to be $4 million.

Paul Sparks Net Worth is a valuable measure of his financial success and can be insightful for understanding the financial status of a particular individual. It can also provide insights into the individual's earning potential, spending habits, and overall financial health.

The concept of Net Worth and its calculation have a long history. The basic principles of Net Worth calculations can be traced back to the 15th century, when Italian merchants used a similar method to assess their financial health.

Paul Sparks Net Worth

Paul Sparks Net Worth is a measure of his financial success and wealth. It is calculated by subtracting his liabilities from his assets. Net Worth is a valuable metric for understanding an individual's financial health and can provide insights into their earning potential, spending habits, and overall financial management skills.

- Assets

- Liabilities

- Income

- Expenses

- Investments

- Savings

- Debt

- Credit Score

- Financial Goals

- Estate Planning

A person's Net Worth can fluctuate over time, influenced by various factors such as changes in income, expenses, investments, and debt levels. It is important to regularly assess and manage one's Net Worth to ensure financial stability and achieve long-term financial goals.

| Name | Birth Date | Birth Place | Occupation |

|---|---|---|---|

| Paul Sparks | October 16, 1971 | United States | American actor |

Assets

Assets are resources with economic value that an individual, corporation, or country owns or controls with the expectation that it will provide a future benefit. Paul Sparks Net Worth is directly influenced by the value of his assets.

Assets can be classified into two main categories: current assets and non-current assets. Current assets are those that can be easily converted into cash, such as cash on hand, accounts receivable, and inventory. Non-current assets are those that cannot be easily converted into cash, such as land, buildings, and equipment.

Paul Sparks's Assets likely include a combination of current and non-current assets. His current assets may include cash in the bank, investments, and royalties from his acting work. His non-current assets may include his house, car, and other personal belongings.

Liabilities

Liabilities are debts or obligations that an individual, corporation, or country owes to another party. In the context of Paul Sparks Net Worth, Liabilities represent any financial obligations that he owes. These Liabilities can have a significant impact on his overall financial health and Net Worth.

- Loans

Loans are common types of Liabilities that involve borrowing money from a lender, such as a bank or credit union, with the obligation to repay the loan amount plus interest over time.

- Mortgages

Mortgages are specific types of loans used to finance the purchase of real estate, such as a house or land. Mortgages typically involve a long-term repayment period and can be a significant Liability.

- Credit Card Debt

Credit card debt is another common type of Liability that arises when an individual uses a credit card to make purchases and does not pay off the balance in full each month. Credit card debt can accumulate quickly and can have high interest rates, making it an expensive form of Liability.

- Taxes

Taxes are financial obligations that individuals and businesses owe to government entities, such as federal, state, and local governments. Taxes can include income tax, property tax, and sales tax, among others.

It is important for Paul Sparks to carefully manage his Liabilities to maintain a healthy financial position. High levels of Liabilities can strain his cash flow, make it difficult to save money, and negatively impact his Net Worth. By understanding the different types of Liabilities and their implications, Paul Sparks can make informed decisions about his financial management and work towards improving his overall financial health.

Income

Income plays a crucial role in determining Paul Sparks Net Worth. It represents the inflow of financial resources that contribute to his overall wealth. Income can come from various sources, each with its own implications for his financial well-being.

- Acting Salary

Paul Sparks's primary source of Income is his salary from acting in films, television shows, and theater productions. His acting skills and experience command a significant salary, which forms a substantial part of his Net Worth.

- Royalties

In addition to his acting salary, Paul Sparks also earns Income from royalties on his past work. Royalties are payments made to creators for the ongoing use or distribution of their work, such as reruns of television shows or streaming of movies.

- Investments

Paul Sparks has likely invested a portion of his Income in various assets, such as stocks, bonds, or real estate. Investment returns, including dividends, interest, or capital gains, contribute to his overall Income and Net Worth growth.

- Endorsements

With his fame and recognition, Paul Sparks may also earn Income from endorsements or sponsorships with brands or companies. Endorsements involve using his name, image, or likeness to promote products or services in exchange for compensation.

Paul Sparks's Income streams are diversified, which helps mitigateand provides a steady flow of financial resources. Understanding the various components of his Income is essential for evaluating his overall financial health and the growth of his Net Worth.

Expenses

Expenses represent the outflow of financial resources from Paul Sparks's Net Worth. They encompass all costs incurred by him, including personal expenses, business expenses, and investments. Understanding Expenses is crucial for evaluating his financial health and managing his Net Worth effectively.

Expenses play a critical role in determining Paul Sparks Net Worth. High Expenses relative to Income can deplete his financial resources and hinder the growth of his Net Worth. Conversely, managing Expenses efficiently can help him save more, invest more, and ultimately increase his Net Worth.

Real-life examples of Expenses in Paul Sparks Net Worth include living expenses such as housing, food, transportation, and entertainment. Business expenses may include costs associated with his acting career, such as travel, wardrobe, and professional development. Additionally, Expenses related to investments, such as management fees or trading commissions, can also impact his Net Worth.

Practical applications of understanding the relationship between Expenses and Paul Sparks Net Worth include:

- Creating a budget to track and control Expenses.

- Identifying areas where Expenses can be reduced or optimized.

- Prioritizing Expenses based on their impact on Net Worth.

By managing Expenses effectively, Paul Sparks can increase his savings, maximize his investment returns, and ultimately grow his Net Worth over time.

Investments

Investments play a critical role in the growth and preservation of Paul Sparks Net Worth. By allocating a portion of his Income to investments, Paul Sparks can potentially multiply his wealth over time. Investments provide a means to generate passive Income, appreciate in value, and hedge against inflation.

Examples of investments that Paul Sparks may have include stocks, bonds, real estate, and private equity. Each type of investment carries its own risk and return profile, allowing Paul Sparks to diversify his portfolio and manage his risk tolerance. Stocks represent ownership in publicly traded companies and offer the potential for capital appreciation and dividends. Bonds are loans made to corporations or governments and provide a fixed rate of return. Real estate can generate rental Income and appreciate in value over time. Private equity involves investing in privately held companies and can offer high returns but also carries higher risks.

Understanding the relationship between investments and Paul Sparks Net Worth is crucial for effective financial planning. By investing wisely and managing his portfolio strategically, Paul Sparks can increase his Net Worth significantly over the long term. Regular reviews of his investment performance and adjustments based on market conditions and financial goals are essential for maximizing returns and preserving capital.

In summary, investments are a vital component of Paul Sparks Net Worth, providing the potential for wealth growth, passive Income generation, and financial security. By understanding the risks and rewards associated with different types of investments and managing his portfolio effectively, Paul Sparks can harness the power of investing to achieve his financial goals and secure his financial future.

Savings

Savings are an integral part of Paul Sparks Net Worth. Savings represent the portion of Paul Sparks's Income that is not spent on immediate Expenses and is set aside for future use. Savings can be held in various forms, such as cash, bank accounts, and investment accounts. By saving a portion of his Income, Paul Sparks can accumulate wealth over time and increase his Net Worth.

Savings play a crucial role in Paul Sparks's financial well-being. They provide a financial cushion for unexpected expenses, emergencies, and future financial goals. Savings also allow Paul Sparks to take advantage of investment opportunities that can further grow his Net Worth. For example, Paul Sparks may choose to invest his savings in stocks, bonds, or real estate, which have the potential to generate passive Income and appreciate in value over time.

Understanding the relationship between Savings and Paul Sparks Net Worth is essential for effective financial planning. By consistently saving a portion of his Income and investing it wisely, Paul Sparks can increase his Net Worth and secure his financial future.

Debt

Debt is a significant aspect of Paul Sparks's Net Worth, representing his financial obligations and liabilities. It can have both positive and negative implications for his financial well-being and should be carefully managed to maintain a healthy Net Worth.

- Mortgages

Mortgages are long-term loans used to finance the purchase of real estate, such as a house or land. They typically involve a down payment and monthly payments over a period of 15 to 30 years. Mortgages can be a form of debt, but they can also be considered an investment in an appreciating asset.

- Personal Loans

Personal loans are unsecured loans used for various purposes, such as debt consolidation, home renovations, or unexpected expenses. They typically have higher interest rates than mortgages and shorter repayment terms.

- Credit Card Debt

Credit card debt is a common form of debt that arises from unpaid credit card balances. It can accumulate quickly and become a significant financial burden if not managed responsibly.

- Tax Debt

Tax debt results from unpaid taxes, such as income tax, property tax, or sales tax. It can have serious consequences, including penalties, interest charges, and even legal action.

Understanding the different types of debt and their implications is crucial for Paul Sparks to effectively manage his Net Worth. High levels of debt can strain his cash flow, reduce his savings, and make it difficult to achieve his financial goals. By carefully managing his debt and prioritizing its repayment, Paul Sparks can maintain a healthy financial position and work towards increasing his Net Worth over time.

Credit Score

Credit Score is a crucial aspect of Paul Sparks Net Worth, providing insights into his financial credibility and creditworthiness. A high Credit Score can unlock favorable terms and lower interest rates on loans and credit cards, ultimately impacting his overall financial health.

- Payment History

Payment History comprises the timely repayment of debts, including credit card payments, loans, and utility bills. A consistent record of on-time payments positively influences Credit Score. - Credit Utilization

Credit Utilization measures the amount of credit used compared to the total credit available. Keeping Credit Utilization low demonstrates responsible credit management and improves Credit Score. - Length of Credit History

Length of Credit History refers to the duration of time that credit accounts have been open. Longer credit histories with positive repayment behavior contribute to a higher Credit Score. - New Credit Inquiries

New Credit Inquiries represent applications for new credit, such as loans or credit cards. Frequent inquiries in a short period can lower Credit Score, as they indicate a potential increase in financial risk.

Understanding these components of Credit Score empowers Paul Sparks to manage his credit responsibly, maintain a strong financial standing, and positively impact his Net Worth. By consistently making on-time payments, keeping Credit Utilization low, maintaining a long and positive credit history, and minimizing unnecessary credit inquiries, Paul Sparks can improve his Credit Score and access more favorable financial opportunities.

Financial Goals

Financial Goals play a pivotal role in the trajectory of Paul Sparks Net Worth. They serve as guiding principles that direct his financial decision-making and impact his overall financial well-being. Financial Goals establish specific targets and aspirations, providing a roadmap for managing and growing his Net Worth.

The relationship between Financial Goals and Paul Sparks Net Worth is bidirectional. Financial Goals shape the strategies and actions taken to accumulate wealth, while the achievement of Financial Goals contributes to the growth of his Net Worth. For instance, a Financial Goal to save a certain amount for retirement necessitates a plan for regular savings and investments, which in turn increases his Net Worth over time. Conversely, the current value of his Net Worth influences the feasibility and timeline for achieving his Financial Goals.

Practical applications of understanding the connection between Financial Goals and Paul Sparks Net Worth include:

- Prioritizing Financial Goals based on their importance and urgency.

- Creating a realistic plan to achieve Financial Goals, considering both income and expenses.

- Regularly tracking progress towards Financial Goals and making adjustments as needed.

By aligning his actions with well-defined Financial Goals, Paul Sparks can make informed decisions that contribute to his overall financial success and the growth of his Net Worth.

Estate Planning

Estate Planning is a crucial aspect of managing Paul Sparks Net Worth and ensuring the preservation and distribution of his assets according to his wishes. It involves proactive measures taken during one's lifetime to manage the transfer of assets after death.

- Will

A Will is a legal document that outlines how an individual's assets will be distributed after their death. It allows for the designation of beneficiaries, executors, and guardians for minor children.

- Trust

A Trust is a legal entity that holds and manages assets on behalf of beneficiaries. It can be used to reduce estate taxes, manage assets for heirs who may not be financially responsible, and provide for specific needs.

- Power of Attorney

A Power of Attorney is a legal document that grants authority to another person to make financial and healthcare decisions on behalf of an individual if they become incapacitated.

- Beneficiary Designations

Beneficiary Designations allow individuals to specify who will receive assets from retirement accounts, life insurance policies, and other financial instruments upon their death.

By implementing a comprehensive Estate Plan, Paul Sparks can ensure that his assets are distributed according to his wishes, minimize estate taxes, provide for his loved ones, and protect his legacy. Estate Planning is an essential part of financial planning and contributes to the preservation and growth of Paul Sparks Net Worth.

Paul Sparks Net Worth encompasses various aspects of his financial well-being, including assets, liabilities, income, expenses, investments, savings, debt, credit score, financial goals, and estate planning. The article explores the interplay between these factors and their impact on his overall Net Worth. Key insights include the significance of managing expenses and debt effectively, the role of investments in wealth growth, and the importance of setting financial goals to guide financial decision-making.

Understanding Paul Sparks Net Worth provides valuable lessons for financial planning and wealth management. By carefully managing cash flow, investing wisely, and planning for the future, individuals can work towards financial stability, achieve their financial goals, and secure their financial future. The concept of Net Worth serves as a reminder that wealth accumulation is not solely about acquiring assets but also involves responsible financial management and long-term planning.

Unveiling Travis Atwood's Impressive Net Worth: A Journey Of Success

Max Collins Net Worth: How The Actor Earned His Millions

Uncovering Henry Ford II's Net Worth: A Comprehensive Review

ncG1vNJzZmien6DCtH2NmqSsa16Ztqi105qjqJuVlru0vMCcnKxmk6S6cLzArqNmq6CWv6y%2FjKecrWWnpL%2B1tI2hq6ak